-

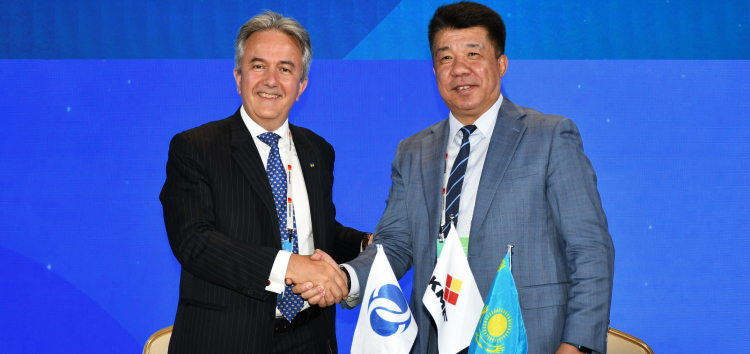

EBRD provides $35 million to micro-lender KMF -

Funds to support women-led businesses -

At least 10 percent of secondary loans will favor green projects

The European Bank for Reconstruction and Development (EBRD) is helping Kazakhstanto micro, small and medium enterprises run by women by granting a new long-term loan to the country’s first micro lender KMF.

The Bank’s funds, amounting to a maximum of US$35 million, will be provided in two tranches and will help promote women’s entrepreneurship and business activity by facilitating access to financing, know-how and technical advice.

It is expected that at least 10 percent of the loans provided by KMF will promote the reduction of energy consumption, encourage greater use of renewable energy sources and help these local businesses adopt environmentally friendly practices .

KMF, a client of the Bank since 2005 and which grants nearly a quarter of microcredits in the country each year, will benefit from technical assistance within the framework of the green loan mechanism, GEFF Kazakhstan IIrecently launched by the EBRD, as well as under the new Kazakhstan Women in Business Program II.

With more than €10 billion invested in the country to date across 304 projects, Kazakhstan is the EBRD’s largest and oldest banking operation in Central Asia.